Bullish Candle Patterns To Learn

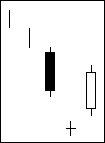

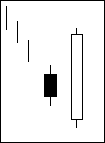

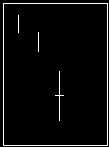

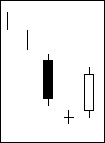

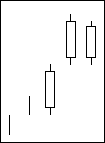

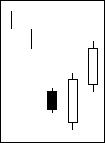

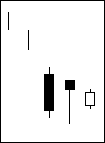

Abandoned Baby Bullish

Like most of the three day star patterns, the scenarios are similar. The primary difference is that the star (second day) can reflect greater deterioration in the prior trend, depending on whether it gaps, is Doji, and so on.

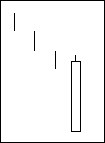

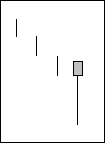

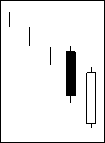

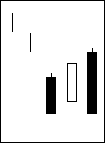

Belt Hold Bullish

The market is trending when a significant gap in the direction of trend occurs on the open. From that point, the market never looks back: all further price action that day is the opposite of the previous trend. This causes much concern and many positions will be covered or sold, which will help accentuate the reversal.

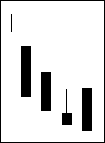

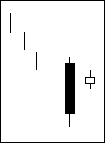

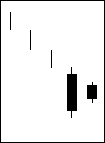

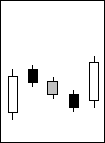

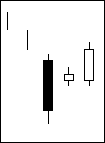

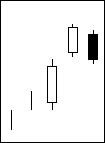

Concealing Baby Swallow Bullish

Any time a downtrend can continue with two Black Marubozu days, the bears must be excited. Then on the third day, the open is gapped down, which also adds to the excitement. However, trading during this day goes above the close of the previous day and causes some real concern about the downtrend, even though the day closes at or near its low. The next day opens significantly higher with a gap. After the opening, however, the market sells off and closes at a new low. This last day has given the shorts an excellent opportunity to cover their short positions.

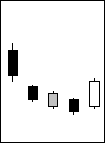

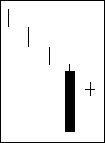

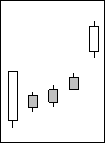

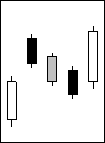

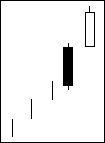

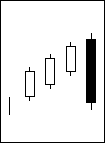

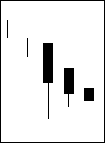

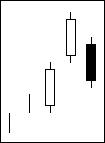

Breakaway Bullish

It is important to realize what is being accomplished here: the trend has accelerated with a big gap and then starts to fizzle, but it still moves in the same direction. The slow deterioration of the trend is quite evident from this pattern. Finally, a burst in the opposite direction completely recovers the previous three days' price action. What causes the reversal implication is that the gap has not been filled. A short-term reversal has taken place.

Engulfing Bullish

A downtrend is in place when a small black body day occurs with not much volume. The next day, prices open at new lows and then climb to a new two day high. The rise is sustained by high volume and finally closes above the open of the previous day. Emotionally, the downtrend has been damaged. If the next (third) days prices remain higher, a major reversal of the uptrend has occurred.

Hammer Bullish

The market has been in a downtrend, so there is an air of bearishness. The market opens and then sells off sharply. However, the sell-off is abated and the market returns to, or near, its high for the day. The failure of the market to continue the selling reduces the bearish sentiment, and most traders will be uneasy with any bearish positions they might have. If the close is above the open, causing a white body, the situation is even better for the bulls. Confirmation would be a higher open with yet a still higher close on the next trading day.

Harami Bullish

A downtrend has been in place for some time. A long black day with average volume has occurred which helps to perpetuate the bearishness. The next day, prices open higher, which shocks many complacent bears, and many shorts are quickly covered, causing the price to rise further. The price rise is tempered by the usual late comers seeing this as an opportunity to short the trend they missed the first time. Volume on this day has exceeded the previous day, which suggests strong short covering. A confirmation of the reversal on the third day would provide the needed proof that the trend has reversed.

Harami Cross Bullish

The Harami Cross starts out the same as that for the basic Harami pattern. A trend has been in place when, all of a sudden, the market gyrates throughout a day without exceeding the body range of the previous day. What is worse, the market closes at the same price as it opened.

Volume of this a Doji day also dries up, reflecting the complete lack of decision of traders. A significant reversal of trend has occurred.

High Price Gapping Play Bullish

The High Price Gapping Play is the bullish counterpart of the Low Price Gapping Play, and leads a new rally out of a stalled upward trend. This pattern is an upside window from a high- price congestion band. After a sharp advance the market consolidates via a series of real small bodies near the recent highs. If prices gap above this consolidation it is a buy signal.

Homing Pigeon Bullish

The market is in a downtrend, evidenced by a long black day. The next day, prices open higher, trade completely within the prior day's body, and then close slightly lower. Depending upon the severity of the previous trend, this shows a deterioration and offers an opportunity to get out of the market.

Inverted Hammer Bullish

A downtrend has been in place when the market opens with a down gap. A rally throughout the day fails to hold and the market closes near its low. Similar to the scenario of the Hammer and Hanging Man, the opening of the following day is critical to the success or failure of this pattern to call a reversal of trend. If the next day opens above the Inverted Hammers body, a potential trend reversal will cause shorts to be covered which would also perpetuate the rally. Similarly, an Inverted Hammer could easily become the middle day of a more bullish Morning Star pattern.

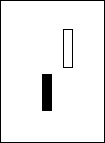

Kicking Bullish

The market has been in a trend when prices gap the next day. The prices never enter into the previous day's range and then close with another gap.

Long Legged Doji Bullish

The Long Legged Doji has long upper and lower shadows with the open and the close very close or the same. This pattern reflects the indecision of buyers and sellers. The open and the close of the day are very close or are the same. The lower and upper shadows are very long. The low of the day is very low and at the bottom of the trend.

Mat Hold Bullish

The market is continuing its rise, with a long white day confirming the bullish action. The next day prices gap open and trade in a small range, only to close slightly lower. This lower close (lower than theopen)is still a new closing high for the move. The bulls have only rested, even though the price action surely brings out the bears. The next couple of days cause some concernthattheupward movemay be injeopardy. These days open about wherethemarket closedonthe previous day and then close slightly lower. Even by the third such day, the market is still higher than the open of the first day (a long white day). An attitude that a reversal hasfaileddevelops and prices rise again to close at a newclosinghigh. This fully supports the bulls' case that this was just a pause in a strong upwardtrend.

Matching Low Bullish

The market has been trading lower, as evidenced by another long black day. The next day, prices open higher, trade still higher, and then close at the same price as before. This is a classic indication of short-term support and will cause much concern from any apathetic bears who ignore it. Apathetic bears are short the market, and quite comfortable with their short position.

If they ignore the Matching Low as a possible trend reversal, it will cause them much concern.

Meeting Lines Bullish

The market has been in a downtrend when a long black day forms, which further perpetuates the trend. The next day opens with a gap down, then rallies throughout the day to close at the same close as the previous day. This fact shows how price benchmarks are used by traders: the odds are very good that a reversal has taken place. If the third day opens higher, confirmation has been given.

Morning Doji Star Bullish

The psychology behind this pattern is similar to that of the Morning star, except that the Doji Star is more of a shock to the previous trend and, therefore, more significant.

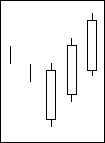

Morning Star Bullish

A downtrend has been in place which is assisted by a long black candlestick. There is little doubt about the downtrend continuing with this type of action. The next day prices gap lower on the open, trade within a small range and close near their open. This small body shows the beginning of indecision. The next day prices gap higher on the open and then close much higher. A significant reversal of trend has occurred.

Piercing Line Bullish

A long black body forms in a downtrend which maintains the bearishness. A gap to the downside on the next days open further perpetuates the bearishness. However, on the day after, the market rallies all day and closes much higher. In fact the close is above the midpoint of the body of the long black day. This action causes concern to the bears and a potential bottom has been made. Candlestick charting shows this action quite well, where standard bar charting would hardly discern it.

Rising Three Methods Bullish

The Rising Three Methods pattern is considered a rest from trading. The psychology behind a move like this is that some doubt creeps in about the ability of the trend to continue. This doubt increases as the small-range reaction days take place. However, once the bulls see that a new low cannot be made, the bullishness is resumed and new highs are set quickly.

Separating Lines Bullish

While the market is in an uptrend, the forming of a long black body should be cause for concern, as this is unusual for a strong market. However, the next day opens much higher, in fact, it opens at the previous black days opening price. Prices then move higher for the rest of the day and close higher, which suggests that the prior uptrend should now continue.

Side By Side White Lines Bullish

The market is in an uptrend. A long white candlestick is formed, which further perpetuates the bullishness. The next day, the market gaps up on the open and closes still higher. However, on the third day, the market opens much lower, in fact, as low as the previous day's open. The initial selling that caused the lower open ends quickly and the market climbs to yet another high. This demonstrates the force behind the buyers, and the rally should continue.

Stick Sandwich Bullish

A good downtrend is under way. Prices open higher on the next trading day and then trade higher all day, closing at or near the high. This action suggests that the previous downtrendhasprobably reversed and that shorts should be protected, if not covered. The next day, prices open even higher, which should cause somecoveringinitially, but then prices drift lower to close atthesame price as two days ago. Anyone who does not note support and resistance points inthemarket is taking exceptional risk. Another day of trading should tell the story.

Three Inside Up Bullish

This pattern, being a confirmation for the Bullish Harami, can only show the success of the previous forecast. The Bullish Three Inside Up is a confirmation pattern for the Bullish Harami. Its pattern is defined by the first two days of the three day pattern forming a Bullish Harami, and the third day giving support to the suggested reversal of the Harami, by being a white candle closing with a new high for the three days.

Three Line Strike Bullish

The market has continued in its trend, aided by the recent Three White Soldiers pattern. The fourth day opens in the direction of the trend, but profit taking or short covering causes the market to move strongly in the opposite direction. This action causes considerable soul searching, but remember that this move completely eradicated the previous three days. This surely dried up the short-term reversal sentiment and the trend should continue in its previous direction.

Three Outside Up Bullish

This pattern representing the confirmation of the Bullish Engulfing pattern, can only show the success of the forecast. The Bullish Three Outside Up is a confirmation pattern for the Bullish Engulfing. Its pattern is defined by the first two days of the three day pattern forming a Bullish Engulfing, and the third day giving support to the suggested reversal of the Engulfing, by being a white candle closing with a new high for the three days.

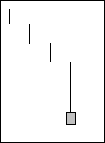

Three Stars in the South Bullish

A downtrend has continued when, after a new low has been made, a rally closes well above the low. This will cause some concern among the shorts because it represents buying, something that has not been

happening until now. The second day opens higher, which lets some longs get out of their positions. However, that is the high for the day. Trading is lower, but not lower than the previous day, which causes a rally to close above the low. The bears are certainly concerned now because of the higher low. The last day is a day of indecision, with

hardly any price movement. Anyone who is still short will not want to see anything more to the up side.

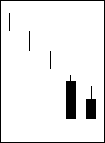

Three White Soldiers Bullish

The Three White Soldiers pattern occurs in a downtrend and is representative of astrongreversal in the market. Each day opens lower but then closes to a new short term high. This type of price action is very bullish and should never be ignored.

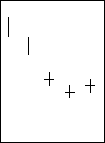

TriStar Bullish

The market has probably been in a downtrend for a long time. With the trend starting to show weakness, bodies probably are becoming smaller. The first Doji would cause considerable concern. The second Doji would indicate that there was no direction left in the market. Finally, the

third Doji would put the last nail in the coffin of the trend. This is essentially because this pattern indicates too much indecision, and everyone with any conviction would be reversing positions

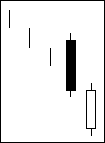

Unique Three River Bottom Bullish

A falling market produces a long black day. The next day opens higher, but the bearish strength causes a new low to be set. A substantial rally ensues in which the strength of the bears is in question. This indecision and lack of stability is enforced when the third day opens lower.

Stability arrives with a small white body on the third day. If, on the fourth day, price rises to new highs, a reversal of trend has been confirmed.

Upside Gap Three Methods Bullish

The market is moving strongly upward. This move is extended further by another day that gaps even more in the direction of the trend. The third day opens well into the body of the second day, then completely fills the gap. This gap-closing move should be looked upon as supporting for the current uptrend. Gaps normally provide excellent support and/or resistance points when considered after a reasonable

period of time. Because this gap is filled within one day, some other considerations should be made. If this is the first gap of a move, then the reaction (third day) can be considered as profit taking.

Upside Tasuki Gap Bullish

The psychology behind a Tasuki Gap is quite simple: Go with the trend of the gap. The correction day (the third day) did not fill the gap and the previous trend should continue. This is looked upon as temporary profit taking. The Japanese widely follow gaps (windows). Therefore, the fact that the gap does not get filled or closed means that the previous trend should continue.